FHA Loans – Overview

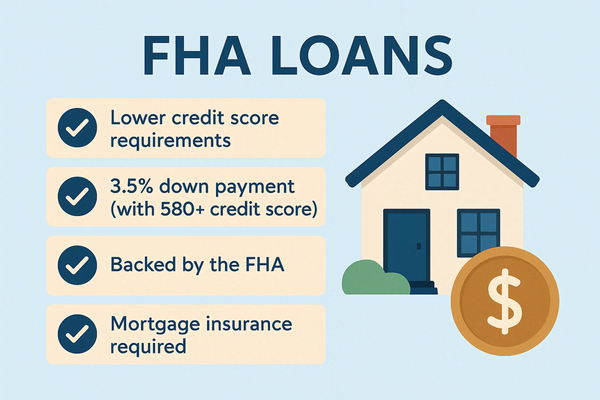

An FHA loan is a mortgage backed by the Federal Housing Administration that is designed to make homeownership more accessible—especially for first-time home buyers. With more flexible credit requirements, lower down payment options (as low as 3.5%), and competitive interest rates, FHA loans offer a great path for buyers who may not qualify for conventional loans. This program helps first-time buyers get into a home sooner and with greater financial confidence, even if they have limited savings or a modest credit history.